Is the worst behind us?

Bitcoin price dipped below $18k in June, lower than the previous cycle’s top, and has since settled in the low $20-23 thousand range. Does this mean the worst is behind us? Or is this just a bear market rally?

The crypto market cap has climbed back up to over $1 trillion (dipped slightly below this week). Bitcoin price dipped below $18k in June, lower than the previous cycle’s top, and has since settled in the low $20-23 thousand range. ETH dropped below $1k and rallied up 100% to $2k, and at the time of writing, it is hovering around $1.5k range. Does this mean the worst is behind us? Or is this just a bear market rally?

As I’ve written previously, we are in uncharted macroeconomic territory. We cannot analyze crypto markets, or any markets, without setting up the macro backdrop first, especially now. Essentially, there is too much debt in the system. The global debt to GDP ratio is ~3.5:1! That means the system has 3.5 times more debt than economic output. Our current fiat monetary system is based on debt. Whenever there is a financial “crisis,” it's solved by quantitative easing, which essentially means increasing the money supply in the system through debt. We saw this in the 2008 financial crisis and again during Covid.

In the short term, the increased liquidity in the market was good for asset prices across the board. However, there’s no such thing as a free lunch. The consequences resulted in 40-year high inflation rates in developed economies such as the US and EU. Currently, there are over 2 billion people in the world experiencing double-digit inflation. Central banks are now increasing interest rates to try to temper inflation without plunging the economy into a recession, using phrases like “threading the needle” or “soft landing.”

The situation in the EU is particularly worrying. Heading into winter, energy prices are skyrocketing. Germany, the strongest economy in the EU, is experiencing their highest energy costs EVER, 14x more than the seasonal average in the past 5 years.

To conclude, macro is still not looking great. However, there are promising developments in crypto that could have a positive impact on digital asset prices. BlackRock, the largest asset manager in the world with almost $10 trillion in assets under management, just started offering institutional clients exposure to bitcoin. In addition, the Ethereum Merge is finally here and officially scheduled for September 15/16, 2022, where it will shift from proof-of-work to a proof-of-stake consensus mechanism.

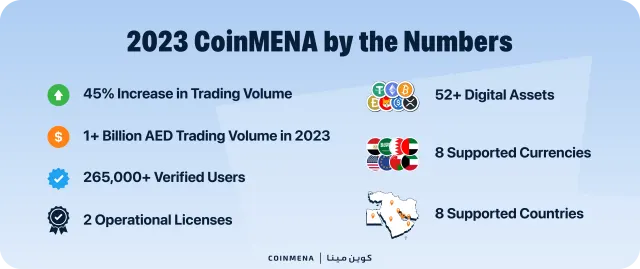

The crypto sector is maturing, and more institutional investors are coming on board every day. We see this trend globally, as well as firsthand here at CoinMENA. So is the worst behind us? In the short term, probably not because of the macro backdrop. Long-term though, there are several positive developments, and I am more bullish than I’ve ever been.