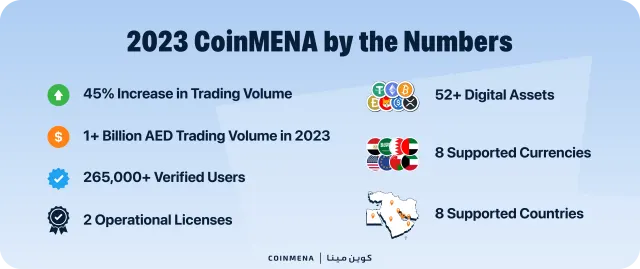

Bank bailed out (kind of). Are you ready for the next Bull Run?

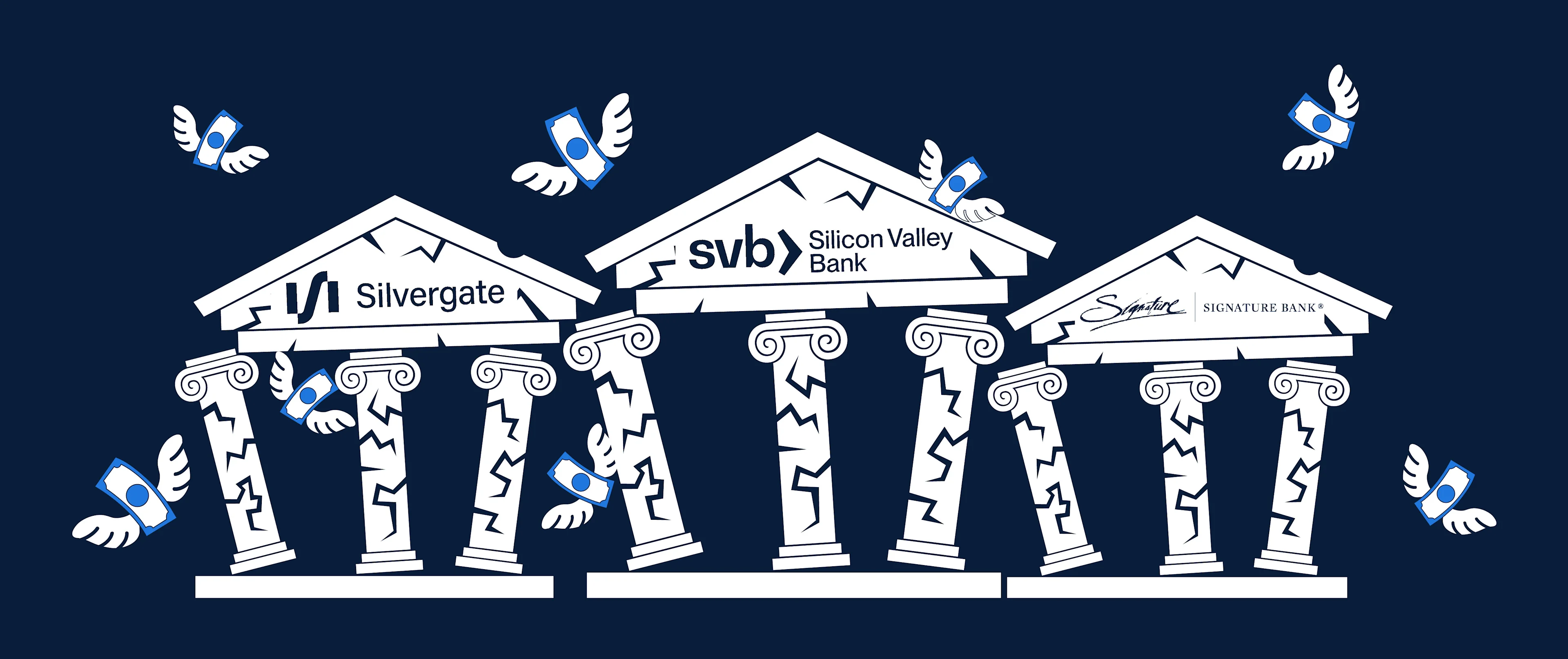

Three US banks failed over the weekend: Silvergate, Silicon Valley, and Signature, with more to come probably in the coming days.

“The Times 03/Jan/2009 Chancellor on Brink of Second Bailout for Banks” ~ Bitcoin Genesis Block

We are in the early stages of yet another banking crisis that is likely to be solved by further debasing the currency and printing more money. Three US banks failed over the weekend: Silvergate, Silicon Valley, and Signature, with more to come probably in the coming days. Unfortunate, but not surprising. The Fed was caught between a rock and a hard place, if they didn’t backstop deposits, it could have set back the US tech industry years with the number of tech firms affected. The Fed just announced they are stepping in to “backstop customer deposits”, but they’re not calling it a “bailout” this time. This is the inevitable result of constant market intervention. Contrary to popular consensus, the current financial system is not a free market, it is an interventionist market.

Market Intervention:

This became overtly obvious in the 2008 Great Financial Crises (GFC) when banks were deemed too big to fail, and the fed stepped in with the largest Quantitative Easing (QE) measures in history (thus far). 12 years later, QE during Covid dwarfed that of the 2008 GFC. The United States Federal Reserve increased the money supply (M1) five-fold (from roughly 4 trillion to 20 trillion dollars) and kept interest rates near zero. The result? All-time high asset prices, followed by 40-year high CPI inflation as the new money worked its way through the system. To tame inflation, the Fed embarked on the fastest interest rate hike in history, going from zero to 4.75% in under one year. Instead of allowing free markets to determine the rates, a body of unelected officials (The Fed) did.

Raising interest rates in a high debt environment has never been done before. Something was bound to break, and this weekend, it did.

Something broke:

Actually, several things broke. First, Silvergate, then Silicon Valley Bank, and then Signature Bank.

The story is unfolding so fast, so let’s deep dive into one of these failures. Silicon Valley Bank (SVB) was the second-largest bank failure in the history of the United States. In 2021 SVB saw a mass increase in deposits, which jumped from $61.76bn at the end of 2019 to $189.20bn at the end of 2022. As deposits grew, SVB needed to generate yield on this influx of capital, so they purchased $80 billion in mortgage-backed securities (MBS) with these deposits. The majority (97%) of these MBS were 10 years in duration, with a weighted average yield of 1.56%. However, when the Fed raised interest rates in 2022 and continued to do so through 2023, the value of SVB’s MBS plummeted. This is because investors can now purchase long-duration "risk-free" bonds from the Fed at a 2.5x higher yield. SVB’s portfolio was suffering from a maturity mismatch. When SVB revealed that they had sold $21 billion for their Available For Sale (AFS) securities at a $1.8bn loss, this triggered a run on the bank, and within less than 48 hours, SVB was closed by the regulator, and the Federal Deposit Insurance Corporation (FDIC) was appointed as the receiver.

Risky business, or systemic risk?

There’s a lot to unpack here, but I want to focus on this: The primary reason for the failure of SVB was the decision to invest customers' deposits in treasury bonds. Let that sink in. It was assumed for decades that US Treasury bonds are supposed to be “risk-free”. In reality, nothing is risk-free. In fact, under FDIC regulations, deposits are only insured up to $250,000 per depositor! 97% of the deposits in SVB were above $250,000, so technically they are not insured by the FDIC. At least, that's what the law was prior to this weekend. In a Sunday evening emergency meeting, the regulators announced that they will be covering all customer deposits, seemingly lifting the insurance amount from $250,000 to infinity. If SVB was not rescued it would have been a disaster for the US tech startup sector as it is estimated that 50% of all VC and tech startups bank with SVB.

Fact: all banks are technically insolvent. This is a reality check that most choose to ignore. Banks operate on a fractional reserve basis. Meaning they are only required to keep between 8%-15% of deposits, and the rest are loaned out or rehypothecated into other investment instruments (i.e SVG’s MBS). Technically, if depositors at any bank all decide to withdraw their money at the same time, they can’t. It is a confidence game. You might ask, why can’t the banks just keep the deposits they have on hand and back their customer’s deposits 1:1. Solid question, but banks don’t do it because under fractional reserve regulations, that would be called “capital inefficiency”.

If banks start to fail because “risk-free” bonds are marked to market instead of book value, then it's not due to risky subprime investments like in 2008. Instead, it's a systemic risk in the financial sector. One that can affect all commercial banks. This becomes an issue if customers withdraw large sums of money, forcing banks to sell their securities at a loss before maturity instead of the full amount when they mature.

If you purchased a 10-year bond for 1,000,000 USD paying a fixed 1% per year, you can redeem the 1,000,000 USD in full at the end of 10 years. If the interest rate is increased by the Fed to 3%, the value of the bond will be significantly lower than the 1,000,000 USD you paid for. If you don't need the money now, it is not an issue as you get the full 1,000,000 USD at maturity. What happened with SVB and other banks, is they had to sell those securities at a loss because they had to honor customer withdrawals.

To recap, this crisis was instigated by the Fed flooding the economy with cheap capital, then withdrawing all that liquidity at the fastest rate in history.

Broken trust:

Every quarter, the Fed publishes rate forecasts. In Dec 2020, their median estimate for 2023's rate was 0.1%. But today, it's actually 4.75%. Off by >47X! So any bank (e.g. SVB) who bought long-term bonds on that Dec 2020 guidance got destroyed because they trusted what the Fed announced in 2020.

I find it fascinating that many bankers and people working in finance believe in free markets, but still, believe the Fed should be setting interest rates (despite failing to forecast it properly for decades).

Alternative free market system - crypto:

“The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” - Satoshi Nakamoto

Bitcoin was created in 2009 as a response to the 2008 financial crisis. As we start to see more and more cracks in the outdated financial system, companies and individuals will start to appreciate the importance of a permissionless, decentralized, and secure financial/monetary network that is governed by code and not reactive humans.

At the first sign of trouble, the Fed stepped in with yet another bailout for banks, but this time it's called a backstop, where they are guaranteeing customer deposits, but not equity or bond holders. This means more money printing and more currency debasement.

We can’t say for certain what the future of finance will look like, but the current model is not sustainable as it was not built for a digital world. The switch to crypto won't happen suddenly, but it is inevitable.