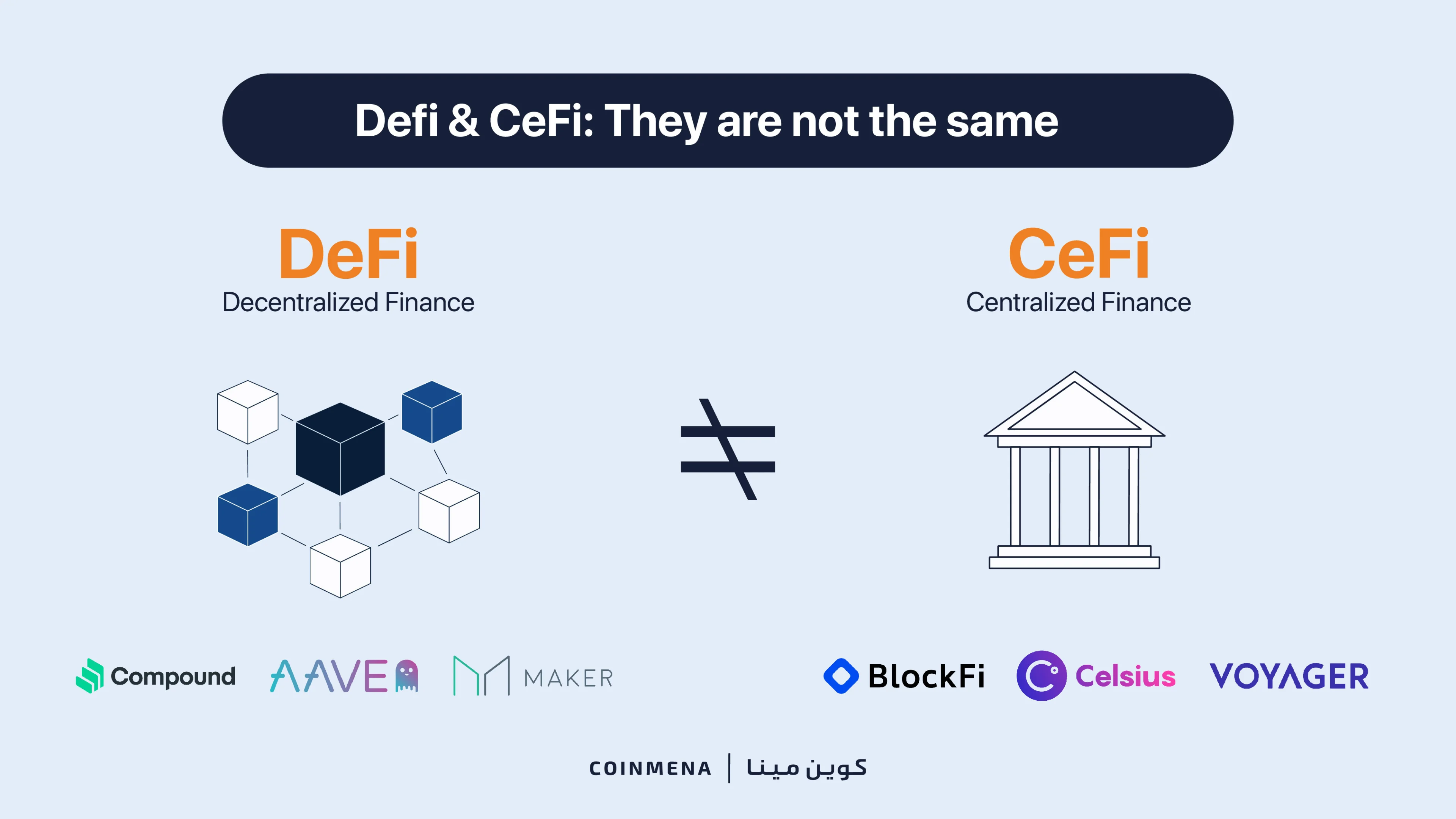

CeFi Is Not DeFi!

It's been an eventful month in crypto, 3AC, Voyager, and Celsius all filed for Chapter 11 bankruptcy protection. Lost in all the noise and chaos of the past month is the fact that decentralized finance (DeFi) actually worked perfectly!

During crypto contagion, DeFi worked!

It's been an eventful month in crypto, 3AC, Voyager, and Celsius all filed for Chapter 11 bankruptcy protection, and BlockFi was effectively bailed out by FTX. Crypto critics are having a field day writing about the death of crypto. During market downturns like we’re experiencing, nuance goes out the window and is replaced with sensationalist clickbait headlines like “Lehman without bailouts” “Crypto contagion” and “Death of DeFi”. Lost in all the noise and chaos of the past month is the fact that decentralized finance (DeFi) actually worked perfectly!

First, we need to understand that crypto lenders like Celsius, BlockFi, and Voyager, are NOT DeFi. They are centralized entities offering crypto lending products, but instead of fiat, it is crypto. The correct term to describe them is Centralized Finance or (CeFi). CeFis operate like traditional fiat banks and are not “crypto”. Agreements are governed by traditional contracts instead of smart contracts. Put bluntly, CeFi’s promise of yields is fundamentally an off-chain, unverified claim that users have to take on faith. The bankruptcy filings revealed details that, like banks during the 2008 financial crisis, CeFi lenders took short-term deposits and made risky long-term loans, and were irresponsibly over-leveraged.

DeFi protocols like Compound, Aave, Maker, Uniswap, and other decentralized apps (DApps) are on-chain protocols governed by smart contracts, and that's a huge difference. The advantage of smart contracts in DeFi is that it removes the subjectivity of the human element. Deals are done transparently and on the blockchain, instead of in private boardrooms and confidential agreements. Disputes are settled instantly and automatically by computer code instead of taking months or years in a court of law. This was demonstrated recently in the aforementioned bankruptcies.

For example, the chapter 11 filings of Celsius showed the company has $5.5 billion in liabilities, $4.7 billion of which is owed to users, AFTER they repaid 100% of their debt, $800 million, to DeFi protocols Compound, Aave, Maker, and other DApps. The collateralized loans to DeFi protocols were released automatically because they are governed by smart contracts. CeFi had no choice and had to repay the loans. Whereas users of the CeFi platform Celsius don’t know if they will ever get their funds back. Their fate will be decided by lawyers and liquidators arguing in the courts.

In the court of law, there is ambiguity and outcomes are not always predictable, but in the world of DeFi and smart contracts there is no ambiguity and you can’t argue. DeFi has performed flawlessly during the worst liquidation event in crypto history. If the last month has proved anything, it is that DeFi works.