Kalam Crypto #76: AI will use crypto, ETH Staking & BTC transaction fees surging

This week, the U.S. regulators sue Binance, ETH staking queue reached 44 days, Bitcoin transaction fees surging, and our blog of the week about AI and cryptocurrencies.

"There is only one thing in the world worse than being talked about, and that is not being talked about." Oscar Wilde

Ahlan wa sahlan, and welcome to the 76th edition of CoinMENA's weekly newsletter, Kalam Crypto. This week, the U.S. regulators sue Binance, ETH staking queue reached 44 days, Bitcoin transaction fees surging, and our blog of the week about AI and cryptocurrencies. All that and more, so let's dive into this week's letter, and talk crypto:Prefer to listen to Kalam Crypto instead? Check out our podcast:

Local News 📍

UAE Central Bank releases AML/CTF guidelines for virtual assets: The Central Bank of the UAE has issued comprehensive guidelines on anti-money laundering and combating the financing of terrorism for Licensed Financial Institutions (LFIs). The guidelines address virtual assets, including cryptocurrencies and non-fungible tokens. Including virtual asset providers among LFIs signals to the market that the UAE considers virtual assets as vital components of the overall financial system.

Global News 🌍

U.S. Regulators Sue Binance: The U.S. Securities and Exchange Commission (SEC) has sued Binance Holdings Ltd. and CEO Changpeng Zhao (CZ). According to Bloomberg, the suit accused them of breaking U.S. rules.

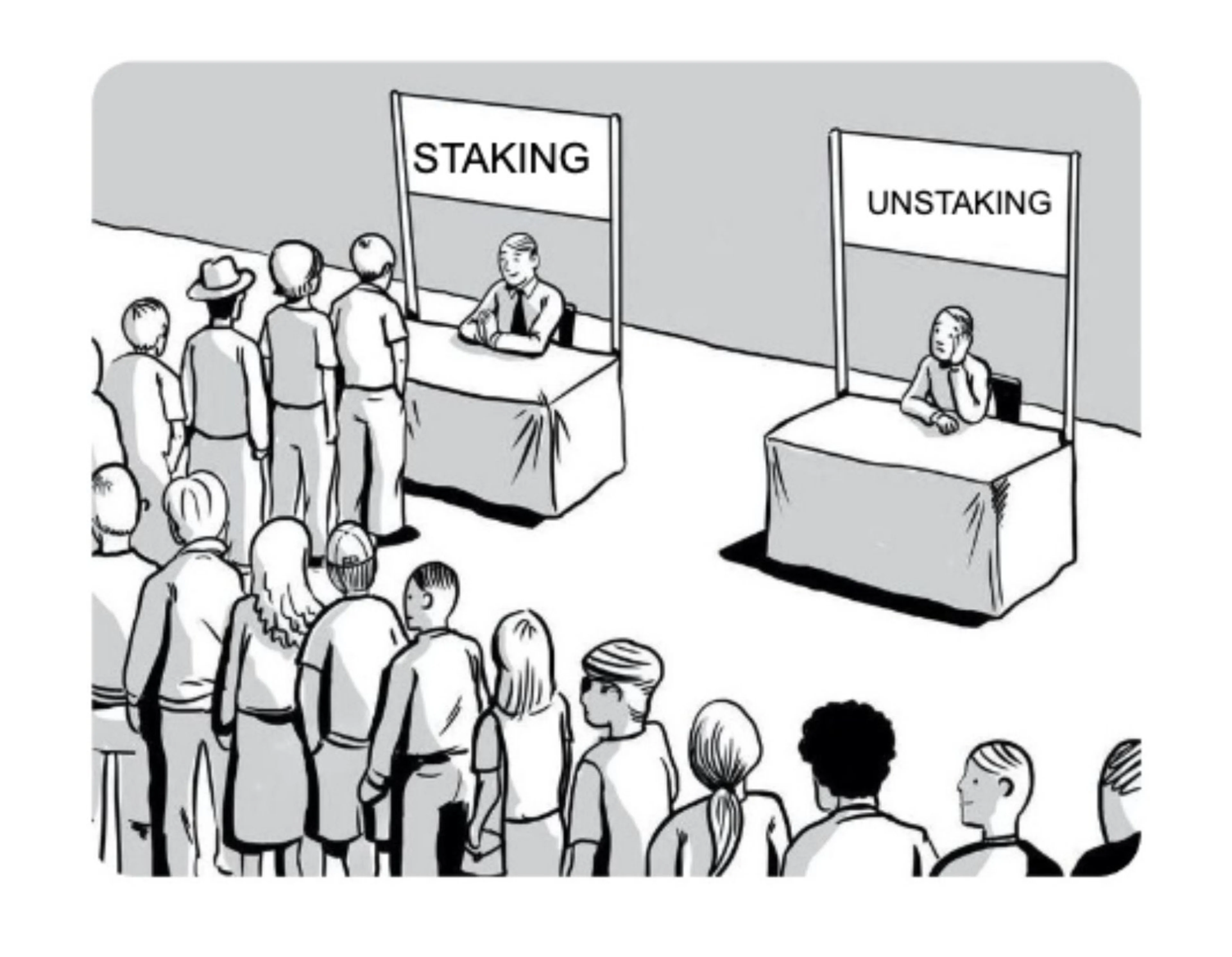

ETH staking queue reaches 44 days: The implementation of the Shanghai upgrade in Ethereum, which enabled validators to un-stake, has led to an increase in staking. While there is no queue for unstaking their ETH, stakers now face a 44-day waiting period to stake their ETH and become validators on the ETH PoS chain. Since the Shanghai upgrade, there has been a substantial increase in demand for staking, with deposits surpassing withdrawals by approximately $5.5 billion.

Bitcoin transaction fees skyrocketing thanks to Ordinals: Bitcoin mining revenue reached $916.6 million in May, a 13.7% month-over-month increase, driven primarily by an increase in transaction fees from the growth of bitcoin NFTs (Ordinals). The share of mining revenue from transaction fees reached 14.3% in May, marking the highest level in over two years. The transaction traffic on Bitcoin reached a record monthly high of 16.9 million, contributing to the highest monthly revenue since last May. Bitcoin is now the second-most active network for NFTs after Ethereum.

Deep Dive 🔬

One year after Terra/Luna/UST collapse - The current state of the stablecoin market:

The collapse of Terra/Luna/UST triggered the bear market last year, leading to a deleveraging of the system and a crash in asset prices. However, stablecoins have established their product-market fit, serving as a medium of exchange or a store of value in bearish periods. The DeFi market is still flooded with different stablecoins, but there has been a shift towards more centralized issuers like Tether, compared to decentralized stablecoins.

As a point of comparison, in April 2022, approximately 82% of stablecoins' market cap was centralized, with major contributors being USDT, USDC, BUSD, and TUSD. Presently, we are witnessing about 95% centralization. Tether (USDT) alone has surged from 44% of total stablecoins to over 63% today, following the USDC de-peg.

Although many users trusted USDC, the DeFi sector faced a reality check in March when USDC de-pegged below 90 cents due to the revelation of funds being tied up in the now-defunct Silicon Valley Bank by Circle. Consequently, users turned to the perceived safety of USDT as it reached a new all-time high in market capitalization.

Blog of The Week ✍️

Of course, AI will use cryptocurrencies: Check out our CEO Talal Tabbaa’s latest blog post about AI and Cryptocurrencies.

Tweet Of The Week 🐥

CoinMENA News 🗞

📢 Join us for the CoinMENA & Chainlink Community Meetup on June 8th, 2023: Discover the latest updates, hear from industry experts🎤, enjoy snacks🍿, and get exclusive merchandise🎁Limited spots are available, RSVP through the link.

📢50 million SHIB Giveaway: Trade a minimum of $10 before June 10th, 2023, and two of you can earn 25 million SHIB tokens each! Don't miss this incredible opportunity to boost your SHIB holdings and remember More trades = More likely to win!

Quiz Corner ✅

Last week’s question: Which cryptocurrency payment processing company helped facilitate the first Bitcoin Pizza Day transaction?

Answer: BitPay

This week’s question: Which of the following is true about bitcoin?

A. Undefined maximum supply, increasing issuance rate.

B. Fixed maximum supply, decreasing issuance rate.

C. Issuance rate adjusts with current inflation.

See the answer in next week’s newsletter. Or check out our new learning platform https://university.coinmena.com/