Kalam Crypto #37: New Ethereum Merge details & ETH giveaway+25% off trading fees

This week, markets slide after the U.S Fed Chair speech, new details on the Ethereum Merge upgrade, and trading discounts from CoinMENA.

What's normal for the spider is chaos for the fly. -Mortitia Addams”

Ahlan wa sahlan, and welcome to the 37th edition of CoinMENA's weekly newsletter, Kalam Crypto. Every week we will bring you the latest news and developments from the exciting world of cryptocurrencies. This week, markets slide after the U.S Fed Chair speech, new details on the Ethereum Merge upgrade, and trading discounts from CoinMENA. All that and more, so let's dive into this week's letter, and talk crypto:

Prefer to listen to Kalam Crypto instead? Check out our podcast:

Global News 🌍

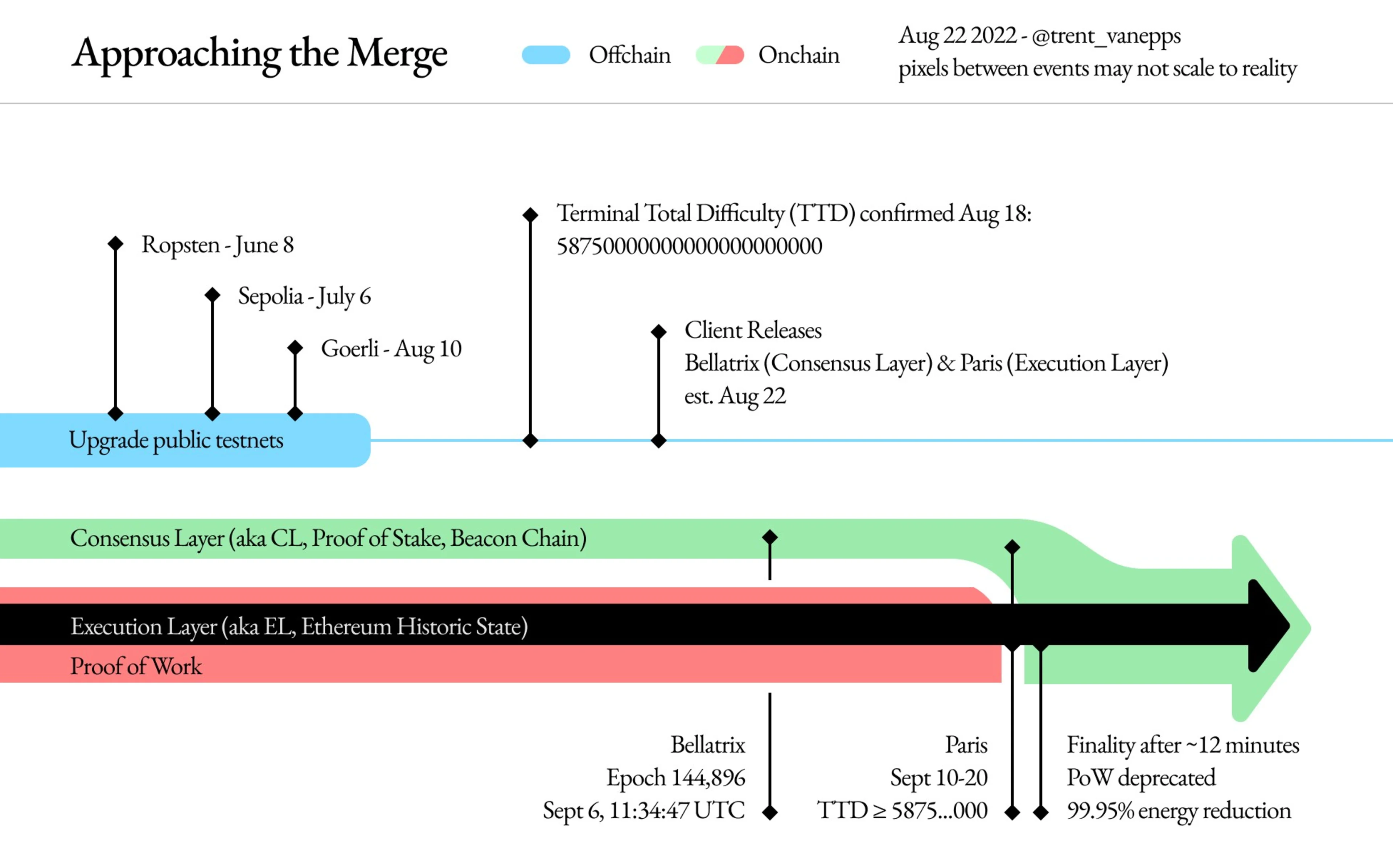

Merge Watch: The Ethereum Foundation announced more details on the upcoming Merge upgrade. The merge will occur in two phases. The first, “Bellatrix,” will occur on September 6, 2022, and the second, “Paris,” will occur between September 10 and September 20, 2022, according to the blog post, which provided the image below.

If you are an Ethereum node operator, the blog includes links to download the necessary upgrades for Ethereum clients. Important to note that if you are an ETH holder, you DO NOT need to do anything.

Markets slide after Federal Reserve Chairman’s speech: Traditional and crypto markets plunged after Jerome Powel’s speech on Friday. The Fed Chair indicated that central banks will likely keep hiking interest rates further. Raising the cost of capital is rarely good news for Wall Street, as the Nasdaq and S&P500 dropped 4% and 3.37% respectively, in one day. Crypto markets experienced similar declines, with bitcoin and Ethereum down approximately 5% since the speech, which pulled the total market cap of crypto back below $1 trillion.

Tether refuses to freeze sanctioned Tornado Cash addresses: Tether, the issuer of USDT, announced they will not freeze sanctioned Tornado Cash addresses until they receive a formal request from the US Office of Foreign Assets Control (OFAC). In a statement, the company said: "unilaterally freezing secondary market addresses could be a highly disruptive and reckless move." It is worth noting that most of the addresses on the Special Designated Nationals (SDN) list were USDC smart contracts linked to Tornado Cash. USDC issuer Circle promptly obeyed the sanctions by blacklisting more than 35 Ethereum addresses.

CoinMENA News 🗞

25% off on trading fees & $5,000 ETH Giveaway: Enjoy discounted trading fees and be in the running to earn $250 ETH! To qualify, buy/sell for $25 or above before 31 August 2022, Wednesday, at 11 PM Bahrain/KSA time.

Blog of the week 📝

Check out our founders' Dina Sam'an & Talal Tabbaa deep dive blog post about the current state of the financial and crypto markets.

https://blog.coinmena.com/articles/6OeaLa5lCAv8NagyYsxdWe

Tweet of the week 🐥

… Thank you Mr. Powell 😒

Quiz Corner ✅

Last week’s question: Which of the following is not true after all 21 million bitcoins have been mined?

Answer: Miners will continue earning mining fees

This week’s question: Which tokens run on Ethereum?

Polygon (MATIC)

Tether (USDT)

Uniswap (UNI)

All of the above

See the answer in next week’s newsletter.