The Merge

Ethereum’s long-awaited upgrade to Ethereum 2.0 is finally here. The third and final Goerli testnet successfully migrated to the proof-of-stake (PoS) chain at the beginning of August 2022. The mainnet upgrade is scheduled to take place on 15/16 September.

TLDR:

- Ethereum network will shift from PoW to PoS

- Reduce energy consumption by ~99.95%

- Reduce ETH issuance rate by 90%

- Does not reduce transaction (gas) fees significantly

- ETH becomes net deflationary if gas fees are 16 gwei or above

- Staked ETH withdrawal function will be available 6-12 months after the Merge

Ethereum’s long-awaited upgrade to Ethereum 2.0 is finally here. The final dress rehearsal, the Goerli testnet, successfully migrated to the proof-of-stake (PoS) chain at the beginning of August 2022. This was the third and final successful testnet merge. The mainnet upgrade will take place when Ethereum reaches total terminal difficulty (TTD) 58750000000000000000000, or 15/16 September in plain English to all the normal people reading this.

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether (ETH) is the native cryptocurrency of the platform and is the second largest after bitcoin in terms of market capitalization. Most of the decentralized apps (dApps) and decentralized finance (DeFi) applications you’ve heard of are built on Ethereum. If we consider the purpose of a blockchain is to sell “block space”, then Ethereum’s blockchain is easily the most vibrant blockchain in the crypto ecosystem. This is also the main reason why Ethereum is shifting to PoS; Scalability.

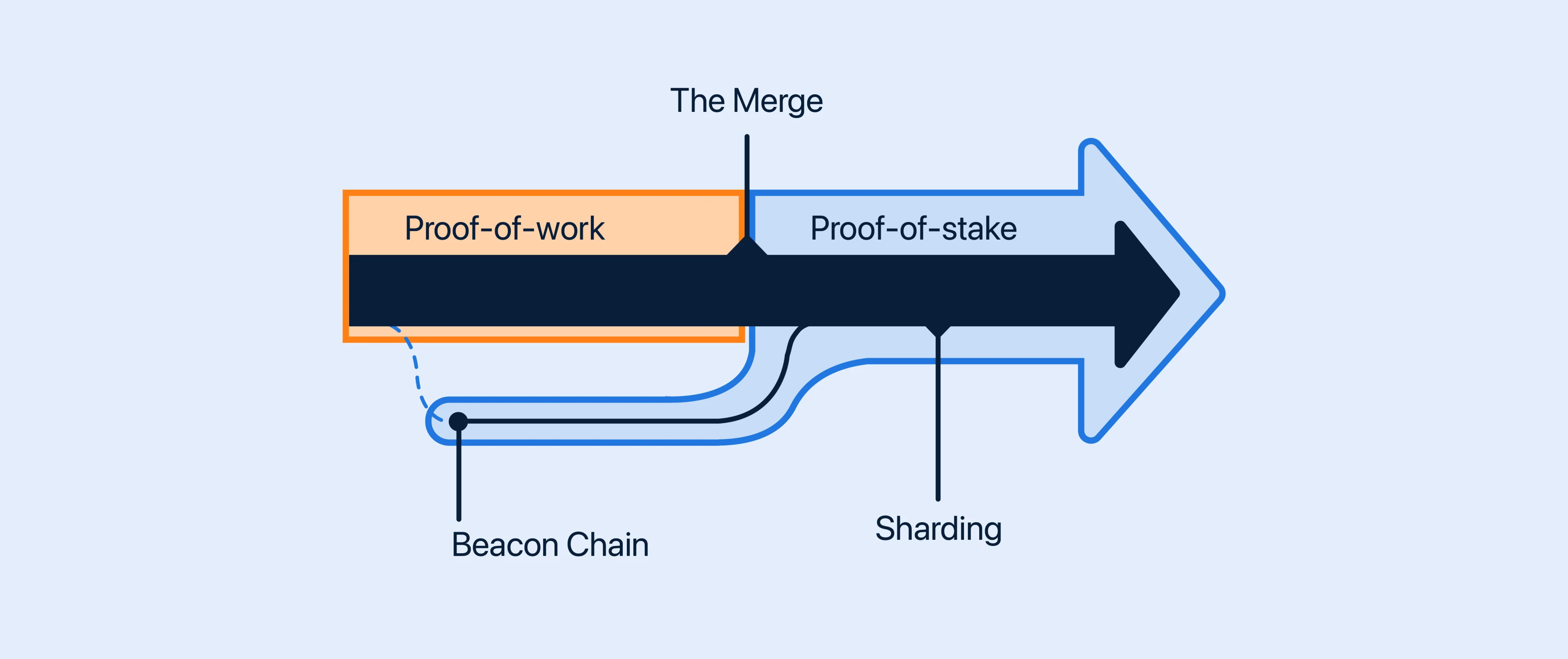

Ethereum founder Vitalik Buterin coined the term “blockchain trilemma”. Essentially all blockchains can optimize for only 2 out of 3 key aspects: Decentralization, Security, and Scalability. Ethereum 1.0’s current configuration uses a proof-of-work (PoW) consensus mechanism, similar to Bitcoin, and is optimized for decentralization and security at the expense of scalability. As demand for Ethereum blocks continues to grow, the Ethereum foundation decided that they should reconfigure their blockchain to optimize for scalability and security at the expense of decentralization. Five years later, and after several delays, the Ethereum 2.0 upgrade is almost here. It is the first time a major layer-1 (L1) blockchain will undergo such a major shift in an essential feature like the consensus mechanism.

First off, it's called the “Merge” because it merges two separate blockchains, the PoW Ethereum Mainnet with the PoS Beacon Chain. The Beacon Chain is an empty PoS chain, launched on December 1st, 2020, to run in parallel with the Ethereum PoW Mainnet and currently doesn't have any transactions or dApps on it.

In PoW systems, anyone with the required hardware can set up a node or mine ETH. With PoS, you have to “stake” a minimum of 32 ETH to become a validator. Or you can stake less than 32 ETH as part of a pooling service like Lido, which will issue you a derivative token (stETH). No special hardware is necessary. Stakers earn ~5% yield on their staked ETH. However, you can still set up an ETH node without staking any ETH, but it will not be able to “propose” blocks.

The biggest impact the Merge will have is on energy consumption. Shifting from PoW to PoS will reduce Ethereum’s energy consumption by ~99.95%! This does not mean PoS is better than PoW because it uses less energy. There are tradeoffs when shifting from a system secured by energy to a system secured by capital, namely decentralization. At the time of writing, almost 60% of all ETH staked is with 4 entities; Lido, Coinbase, Kraken, and Binance, with Lido alone accounting for ~31% of all staked ETH.

Since launching the Beacon chain on December 1st, 2020, the number of validators and amount of staked ETH has been steadily increasing. At the time of writing, there are over 400 thousand validators on the Beacon chain and $20 billion in value or 13.3M ETH, representing ~10% of supply locked in staked ETH. One crucial detail is that staked ETH withdrawals will only become available 6-12 months AFTER the merge. The staked ETH withdrawal feature was purposefully delayed to preserve the stability of the network and protect it from speculative trading. Even when the withdrawal function is active, there will be a queue because it will be limited to around 30k ETH per day. (amount varies depending on the number of validators / 65536).

The block time will be reduced from 13.6 seconds to 12 seconds, which will slightly reduce gas fees, although not substantially because lowering L1 fees was never the goal. Ethereum has a roll-up-centric roadmap where Layer 2 (L2) blockchains (like Arbitrum, ZkSync, Polygon, Optimism) will always have lower fees and experience order of magnitude lower fees when L1 fees are reduced.

Alongside reducing energy consumption, the most significant impact of the Merge is reducing the ETH issuance rate by 90%, from 4.3% to 0.43%. The Ethereum community refers to this as the “triple halving.” In addition, the Ethereum transaction fee structure changed after EIP-1559 was implemented in August 2021, and the majority of transaction fees are burnt instead of paid to miners. Combining these two factors: reduction of issuance by 90% and burning the majority of transaction fees, could make ETH a deflationary asset. If transaction fees are ~16 gwei or higher, the rate of ETH burnt will outpace the ETH issuance rate, making ETH a deflationary asset, or as the Ethereum community calls it, “Ultra Sound Money.”

Shifting a blockchain with the magnitude of Ethereum from PoW to PoS is a monumental task. There are risks associated with any ambitious endeavor. The Ethereum developers took their time and tried to minimize the risks as much as possible. Answering the question of whether the Merge will be successful or what impact it will have on the price of ETH is difficult to say now because there are a lot of variables involved. I’m personally rooting for a successful merge as Ethereum and products built on Ethereum contributed to many of the innovations in crypto, some of which (if successfully scaled) can change the way the world works.