Calm Down and DCA

There is a lot of fear in the market now. This is a reality check that markets do not always go up, and that's okay. They are not supposed to. So what's really causing all this, and what to do now.

Dear Crypto Traders and Investors,

There is a lot of fear in the market now. This is a reality check that markets do not always go up, and that's okay, they are not supposed to. It is known that crypto prices move in cycles following the bitcoin halving every 4 years or so. This cycle is different though, as it is looking more like a global recession than a crypto-specific bear market. Since the beginning of the year, $35 TRILLION in global market value has been lost, including $1T losses in crypto. That's 14% of all global wealth! For reference, the 2008 financial crisis was 19%.

What's causing all this?

In short, this is the delayed after-effects of the Covid shutdown. During Covid, central bankers around the world flooded the market with new money supply (M2) to keep the economy afloat. As a result, asset prices reached all-time highs during an economic shutdown! Crazy. The United States increased M2 by 40% in two years! And despite keeping interest rates at zero for years, inflation CPI reached 8.5%, the highest rate in 40 years! The federal reserve had to act by increasing interest rates, and the markets are responding negatively as expected.

These macroeconomic conditions do not impact crypto’s long-term value proposition. Market prices are driven by sentiment more than fundamentals and value. Cryptocurrencies are a new technology, similar to the internet, which is revolutionizing the world of finance. So despite the market downturn, the long-term trend and outlook for crypto remain very bullish. For example, in the past 6 months, bitcoin and Ethereum are down 55%. However, over 5 year period, bitcoin is up over 1,300%, and Ethererum is up over 1,500%.

So what to do now?

For me personally, nothing different. I’m convinced of the long-term value of crypto, and therefore dollar-cost average into bitcoin every week, regardless of price. I treat it like my savings account.

When asked about investing in crypto, my answer today is the same whether we are in a bull or bear market:

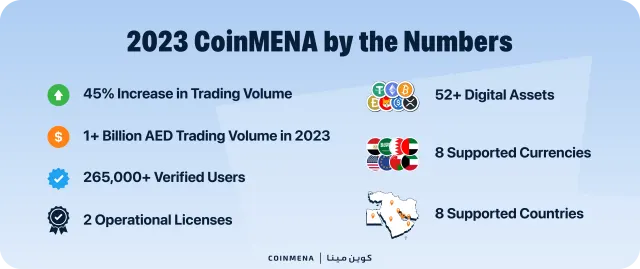

Use a regulated exchange (Like CoinMENA): This is very important because, with a regulated exchange, you can deposit in your local currency and withdraw your money to your local bank account anytime. With unlicensed exchanges, you can only deposit your money but can't withdraw!

Start small: Only invest what you can afford. Start with a small allocation to have "skin in the game" and start paying attention and learning. The best way to learn about something is to participate in it!

Think long term: The best investors in the world think in years, not days or months. Warren Buffet once said, "Do not take yearly results too seriously. Instead, focus on four or five-year averages.”

Do your homework: There are established cryptocurrencies like Bitcoin and Ethereum, and there are "meme coins" like Doge and Shiba. They are not the same. While you are at it, google what "Dollar Cost Averaging" means.

Be patient, not greedy: "Rome wasn't built in a day" Cryptocurrency gains can be exciting, but the volatility works both ways.