Opportunities in a Recession

It's official. We are in crypto winter. Every four years, the market goes through bull and bear cycles. We think it might be different “this time,” but apparently, it’s not. However, this is the first time crypto has experienced an economic recession.

It's official. We are in crypto winter. Every four years, the market goes through bull and bear cycles. We think it might be different “this time,” but apparently, it’s not. However, this is the first time crypto has experienced an economic recession. Bitcoin was born out of the wreckage of the 2008/2009 financial crisis. In fact, on Bitcoin’s genesis block (first block), Satoshi Nakamoto engraved the following “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. The headline, forever engraved on the Bitcoin blockchain, serves as a reminder that Bitcoin was created in response to irresponsible central bank policies which led to the debasement of fiat currencies. The US Federal Reserve is stuck between a rock and a hard place. After increasing the M2 money supply by 40% in response to Covid-19, inflation is at its highest level in 40 years. A recent article in the Financial Times showed the number of emerging and developed economies experiencing inflation of 5% or more is skyrocketing! To reduce inflation, the Fed cannot increase supply, so they have to reduce demand. Reducing demand means a recession. Historically, however, a surprising number of successful businesses were launched during a recession.

Consider Uber and Airbnb. Both companies were launched during the last recession in 2008/2009. Go back a little further, and you’ll find plenty more examples. Apple, Slack, WhatsApp, Pinterest, General Motors, IBM, Groupon, Instagram, and many more were launched during economic recessions. Whatever the sector, history clearly demonstrates that adverse market conditions are not a barrier to innovation. Even Disney was launched in 1929, the year of the Great Depression!

In contrast, bull market start-ups tend to see their valuations rise rapidly, enabling them to expand operations at an equally brisk pace. When – inevitably – a market downturn does occur, these are the firms that must resort to extreme measures like mass layoffs or seeking bailouts.

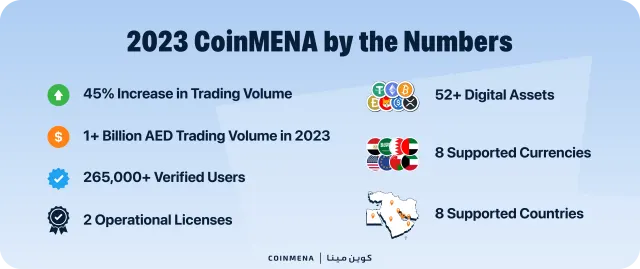

As a startup, we need to adapt to the new realities of the market. Our goal remains to grow our user base and continue to develop new products that enhance our users’ experience. We are particularly excited about our recently obtained provisional license from Dubai’s VARA, as it gives our users and investors regulatory clarity, which is extremely important for our long-term plans. The economic conditions are not ideal, but there is still a lot of value that can be unlocked during these times. It is still very early days for crypto as an industry, and I’m sure that those who survive these turbulent times will emerge stronger than ever.