🦊ETH Staking on MetaMask

Metamask enabling ETH staking could potentially lead to mainstream DeFi adoption similar to how Robinhood popularized stock trading. This will become even more convenient when Metamask adds reliable FIAT rails.

"Simplicity is the ultimate sophistication" - Leonardo da Vinci

The value of a simple & intuitive user experience is invaluable.

If the adoption of crypto follows the same pattern as previous technological innovations such as the internet and smartphones, the current 4% market penetration suggests that we are on the brink of a rapid increase in adoption, i.e. "hyper adoption" phase. One area where crypto needs to improve greatly is simplifying the user experience. Using DeFi still requires a level of sophistication that is not feasible for the average consumer. Metamask enabling ETH staking could potentially lead to mainstream DeFi adoption similar to how Robinhood popularized stock trading. This will become even more convenient when Metamask adds reliable FIAT rails.

MetaMask, the popular DeFi wallet, will allow its ~30+ million monthly active users to stake their ETH directly through the app by selecting Lido or Rocket Pool as their staking provider, allocating the desired amount of ETH, and receiving the relevant liquid staking tokens in return. Usually, a depositor into the ETH2 contract would need to deposit a minimum of 32 ETH to become a validator and earn staking yields, but liquid staking protocols like Lido and Rocket Pool allow users to lock up less than the 32 ETH multiples required to become a validator. Staking by retail /everyday users can also help make Ethereum’s protocol less centralized.

By integrating the staking feature, MetaMask will make DeFi accessible to a much wider audience. DeFi financial services are exponentially more equitable because they are governed by smart contracts, where the borrowing and lending terms are transparent, immutable, and automatically enforced. We saw this in the summer when centralized lenders like Celsius collapsed, the only parties that were paid back were DeFi protocols like Compound, Aave & Maker.

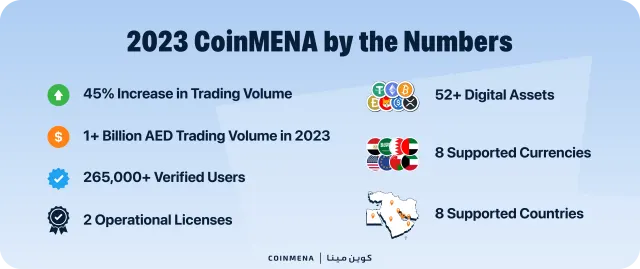

Ultimately, users want the best and most convenient experience. This was our initial goal at CoinMENA; to create a simple and safe way for users to invest in digital assets, and be able to go from fiat to crypto and back efficiently. Our focus in the next phase is to begin offering financial services built on crypto rails. We’ll have some exciting news to announce about this soon.