FTX Fraud Highlights Need for Regulation

Crypto is an industry in its infancy, and still not adequately regulated in most countries.

Crypto is an industry in its infancy, and still not adequately regulated in most countries. FTX took advantage of this regulatory arbitrage and was able to get away with wide-scale fraud. In the short term, this is a major setback for our industry. Unfortunately, it was necessary to flush out the grifters in this space.

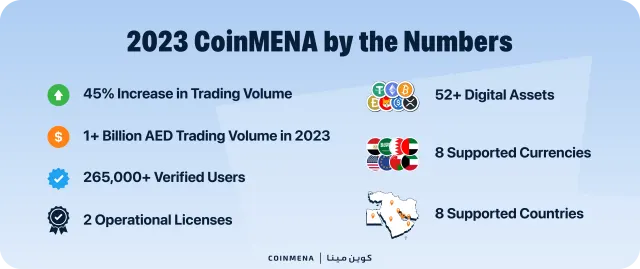

Launching CoinMENA in a regulated jurisdiction was a top priority for us to ensure investors and users are protected. This is why CoinMENA was established under the Central Bank of Bahrain, with a robust regulatory framework and compliance requirements. We go through regular audits and submit periodic reports to the regulators. More importantly, we keep our user funds in segregated accounts and we don't offer leverage or margin which severely increases the risk profile of an exchange.

The FTX chapter 11 bankruptcy filings revealed that the company had $900 million in assets against $9 billion in liabilities! They funneled both customer deposits, and investment capital to Alameda for them to place risky trades with. It also appears they did not have the adequate governance structure in place to separate the exchange (FTX), from the market maker (Alameda), a clear conflict of interest. These should have been red flags that would have been caught much earlier had there been proper oversight.

Long term, it is a net positive that these bad actors are being exposed in the early stages of crypto adoption. Yes, we are still in the very early stages of crypto adoption. This is a pivotal moment that we’ll look back on as a valuable teaching lesson. I suspect it will be the turning point that will finally get regulators across the world to issue clear crypto regulations. In addition, it will serve as a harsh learning lesson for users to only trade on regulated exchanges.

FTX broke the law and took regulatory shortcuts. At CoinMENA, we see crypto as a long-term investment and will continue to work with regulators to make sure we are in compliance and manage our risk diligently to build a sustainable and profitable business.