BlackRock has entered the chat

We were in the middle of an all-time bull market, and there was a sense that this would trigger a cascade of institutional money getting into bitcoin, but it didn't, until now. Enter BlackRock.

On August 10th, 2020, Microstrategy became the first publicly listed company on the US stock exchange to add bitcoin to their balance sheet by purchasing $250 million of bitcoin at an average price of 11,653 per BTC. Since then, bitcoin is up over 100% and their stock $MSTR has outperformed 97% of the S&P 500 stocks. Two months later, Block announced they’re adding $50 million worth of BTC to their balance sheet. Then came TESLA in February of 2021 which raised the stakes with a $1.5 billion BTC purchase. We were in the middle of an all-time bull market, and there was a sense that this would trigger a cascade of institutional money getting into bitcoin, but it didn't, until now. Enter BlackRock.

Last week, BlackRock signed a deal with Coinbase to offer their institutional clients exposure to bitcoin. Later the same week they launched a spot bitcoin private trust enabling direct BTC exposure for its institutional clients.

If you are not familiar with BlackRock, they are the world’s largest asset manager with almost $10 trillion in assets under management. To put that into perspective, the total current market cap of bitcoin is $500 billion, which means that a minor 5% allocation of BlackRock’s assets to bitcoin would double the current market cap of bitcoin. BlackRock’s clients include central banks and sovereign wealth funds. We are talking about a whole new level of institutional funds that could deploy to bitcoin very soon.

The significance of this announcement cannot be overstated. It shows a 180-degree turn from their position 5 years ago. In 2017 BlackRock CEO Larry Fink called bitcoin an “index of money laundering”, and in 2022 they released a statement saying “Bitcoin is the oldest, largest, and most liquid cryptoasset, and is currently the primary subject of interest from our clients within the cryptoasset space."

In an interview after the announcement, CEO Larry Fink said that #bitcoin has caught the imagination of the people because “The hits on BlackRock's website were: 3,000 hits on COVID, 3,000 hits on monetary policy, and 600,000 hits on #bitcoin”

For this to happen in the middle of a bear market is astonishing and shows that the fundamentals of bitcoin are solid enough for the largest asset manager in the world to feel comfortable offering it to their clients.

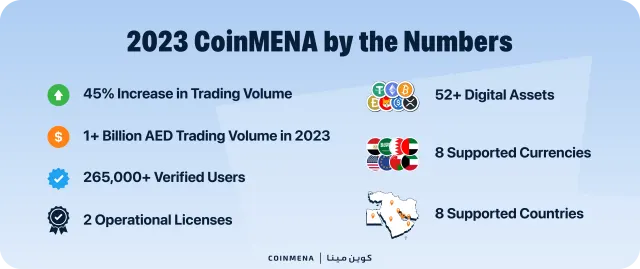

Onboarding institutions has been a top priority for us at CoinMENA from day one. We launched the first licensed OTC desk that provides premium VIP service to institutional clients and high-net-worth individuals, with dedicated account managers available 24/7. BlackRock is coming for your bitcoin, don’t be too late to invest in the best-performing asset in the world over the past decade.